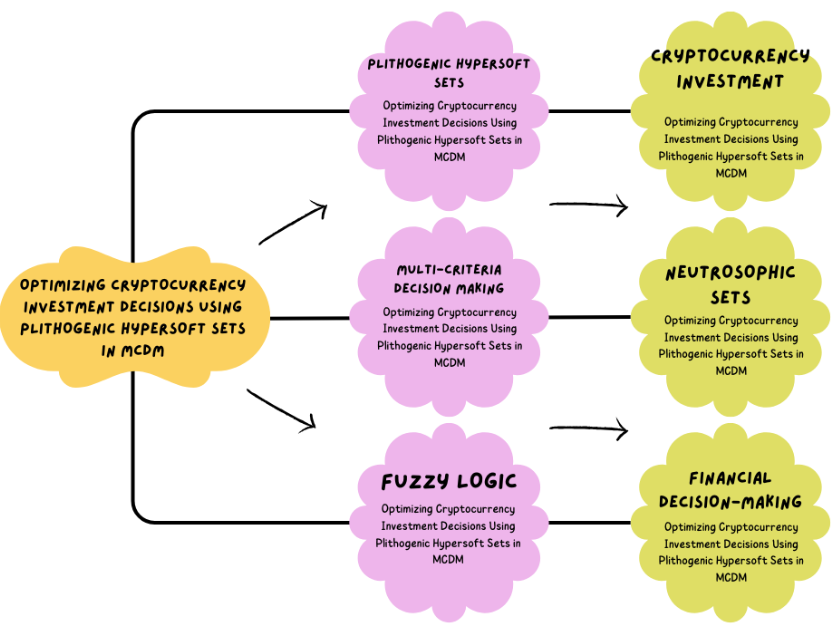

Optimizing Cryptocurrency Investment Decisions Using Plithogenic Hypersoft Sets in MCDM

Main Article Content

Abstract

This study explores the integration of Plithogenic Hypersoft Sets (PHSS) in Multi-Criteria Decision Making (MCDM) for cryptocurrency investment analysis. Given the volatile and unpredictable nature of the cryptocurrency market, traditional decision-making models often fail to capture the complexities and uncertainties present. By incorporating the advanced concept of PHSS, which accommodates multiple membership degrees (fuzzy, intuitionistic fuzzy, neutrosophic), we propose a more robust framework for investment decision-making. The study normalizes cryptocurrency data and applies PHSS to a set of cryptocurrencies (e.g., BTC, ETH, BNB, SOL, and XRP), analyzing key attributes such as price changes, market cap, volume, and circulating supply. Our results demonstrate that PHSS can enhance the accuracy and reliability of financial decision-making, providing valuable insights for investors.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License.